Real Estate Markets & Economy

According to a new report from Redfin, relocating homebuyers continue to seek out more affordable locales in favor of big, expensive coastal cities

Surge in Q3 home prices pushes mortgage giants' conforming loan limits in high-cost housing markets to $1,149,825 for single-unit properties, and up to $2,211,600 for 4-unit properties

LendingTree's latest consumer survey revealed 35% of Americans hope the market will crash in the next 12 months. They believe an economic downturn will lower mortgage rates and home prices

National home prices climbed 3.9% from a year earlier in September and were up 0.7% from the previous month. Detroit was the market with the highest price growth, followed by San Diego

The pilot program, dubbed 'Plus One ADU,' draws on a $2.6M grant from New York State Homes and Community Renewal. As many as 15 eligible single-family homeowners will receive funds

Opinion

According to Keller Williams Head of Inclusion and Belonging Julia Lashay Israel, the Sitzer | Burnett commission case has broad implications for the accessibility of homeownership

Sales of newly built single-family homes clocked in at a seasonally adjusted annual rate of 679,000 during the month of October

Two closely watched forecasts agree that mortgage rates have probably peaked, but the MBA and Fannie Mae diverge sharply on how quickly they'll come down over the next 2 years

Requests for purchase loans were up 4% last week compared to the week before, but down 20% from the same time a year ago, Mortgage Bankers Association's weekly survey of lenders finds

Existing sales fell 4.1% in October to an annual rate of 3.79M, the lowest since 2010, according to data from NAR. Nonetheless, multiple offers are still happening, economist Lawrence Yun said

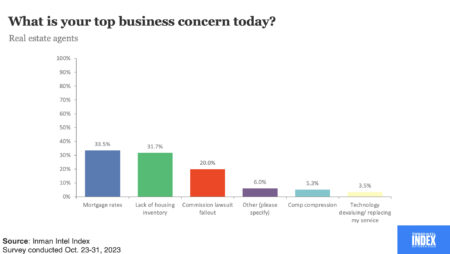

After exceeding 8% in October, rising mortgage rates overtook 'lack of housing inventory' as the top concern for real estate agents, according to the latest monthly Inman Intel Index results.

RentRedi CEO Ryan Barone writes that from smart home enhancements to mobile-friendly tech services, technology is the key to helping college-town landlords thrive in today's market

Don't let the negative headlines get in your head, writes coach and trainer Darryl Davis. Find out how you can come from a positive place and put your best face forward right now

Thirty percent of rentals advertised on Zillow in October offered concessions of some sort, such as free parking or free months of rent, even as rental rates remain high

Please add your voice to the Triple-I, the real estate industry's most ambitious monthly survey

Right now, agents are feeling overwhelmed by potential changes post-Sitzer. Coach Darryl Davis offers wisdom and action steps to shore up your business for the tumultuous market ahead

Housing starts rose 1.9% from September to reach a seasonally adjusted annual rate of 1.372M

Back to top